Despite already being in such a dominating position, we need to continue being aggressive. We now have an extra $700k in budget to play with that none of the other teams have (we are at $8.0m and they are at $7.3m). Due to the wild success of TINY, we decided to try and push it a bit further. Ad spend was increased from $2.5 to $3.0m. This decision was supported by the advertising experiment, which showed that if we had increased our spend in the previous period by 20%, we would have seen an increased contribution of $1.7m from TINY at a cost of $500k, which is quite the bargain if you ask me. TIME's experiment indicated that we may have overspent on advertising. Originally the plan was not to change TIME's ad spend, but we ended up raiding it for something else and dropped it down to $1.2m from $1.5m. We again kept a 9:1 ratio of media spend to ad research.

We also launched a new brand, TINK, this period based off of TINY's R&D project. The reason for this is two-fold. First, we wanted to mess with our competitors' heads. All of our competitors were spreading their ad dollars across several segments for each brand. While this is extremely unwise, it also creates a situation where they get their foot in the door for other segments. The second largest segment behind TINY's target of Singles (SI) was Medium Income (MI). MI was also extremely close to SI on the perceptual maps, which presented the problem of our competitors' brands getting increased MI sales due to advertising. Fortunately, due to the wild success of TINY in the SI segment, it had a spillover effect and we were somehow #1 in the MI segment as well. Though this brings up the worry of cannibalization, MI consumers are not as price sensitive as SI consumers, so a product targeted towards them can have a higher retail price, so any cannibalized sales will result in a higher margin per sale. The second reason is that brand awareness will begin picking up for TINK. Eventually the plan is to R&D a product that is perfect for the MI segment, so when that happens there will be plenty of awareness, and we would then just need to boost advertising to communicate the product feature change. This project is where the raided TIME ad funds went. $363k went into ad spend and $300k went towards a commercial team of 6 and merchandising dollars. Production was set at 800k units, a decision that would prove to be disastrous.

We considered beginning investments into R&D for the Nutrites market, but decided against it due to the massive cost of ~$8m and our lack of funds to make a meaningful dent in that project. This is why we instead put our extra cash (and then some) into TINK.

Using the same methodology as the prior period, TIME's production was set at 5.72m units, and TIME was set at 2.192m units. Prices remained the same.

Results:

Continued domination. And our first major blunders.

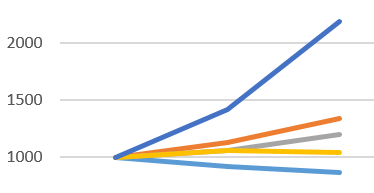

SPI rocketed to 2189. Our closest competitor came in at 1344, which is still below where we were at after period 1. Revenues were $85m with $42m EBT, compared to $56m and $23m for our closest competitor. We also saw another budget jump for next period, this one being incredibly substantial, taking us from $8m to $16.6m. Our closest competitor's budget will be $9m for next period. This is not even fair anymore.

Fortunately for our competitors, we made two very serious mistakes. First and foremost, we under-produced TINY by over 700k units! That cost us ~$1.5m in contribution margin for the period, which is completely unacceptable. We also wildly overproduced TINK. There were only 145k in sales for TINK, which left us with an inventory of 495k units. This cost us $130k in inventory holding costs. Not nearly as bad as what happened with TINY, but unacceptable nonetheless.

TINY has just become absolutely ridiculous. It has 52% of the market share for the SI segment, and 21% of the market share FOR THE ENTIRE MARKET. The closest competitor's brand has 11%. TIME also continues to lead its segment of HE, though not by very much.

Market Share

Contribution

Contribution Margin

SPI

No comments:

Post a Comment